7 reasons why you’re broke

Money can’t buy you happiness.

Broke can’t buy you anything.

Two true statements. If you had the option to choose between having money and being broke, which one will you choose?

Your guess is as good as mine. Yet, people still choose to be broke.

Jelleestone has a popular song titled “Money Can’t Buy Me Happiness” and while I don’t endorse the entirety of the lyrics, I like the line where he says…

“Money can’t buy me happiness, but I’m happiest when I can buy what I want, anytime that I want…”

We know the high we get when we go on a buying spree, and we know that buying stuff will not give you true happiness as Jelleestone seems to suggest in his song.

So, it is obvious money cannot buy you happiness. However, this is not an excuse to be broke because being broke may just be worse — you can’t buy anything.

To get out of your broke state, do the opposite of these 7 things that prevent you from achieving a financial breakthrough.

Here are 7 reasons why you are broke:

1. You are lazy

“Success is not easy and it is certainly not for the lazy.” — The Everygirl

Yes, you heard me right. You are lazy.

Don’t be mad at me. Be mad at yourself.

But if it makes you feel better, we all have our lazy moments. I have my lazy moments and I have my lazy days. This is excusable.

What is not excusable is consistently being lazy day in, day out. If you’re always lazy, you will be broke forever.

You don’t want to put in the hard work required to achieve success.

You give up too soon when you’re just a few steps away from achieving a breakthrough.

You buy into the lie that achieving success in anything is easy. No, it is not.

It never gets easier. You get better.

Achieving success in business and in your career requires hard work. It requires sacrifice. And it requires patience and perseverance.

You may have to work 80-hour weeks. You may have to sleep less. You may have to give up on some of your favorite TV shows for now.

If you work hard and work smarter, success is guaranteed and you will never be broke.

2. You don’t invest in your education

“Learning is not attained by chance, it must be sought for with ardor and attended to with diligence” — Abigail Adams

I had a chat with a friend a few weeks ago who recently invested $40,000 in a U.S Commercial Real Estate Education and Coaching Program.

When I asked him why he invested that much in a program, he replied “If I don’t invest in my education, who will?”

I watched this friend invest $20,000 in a similar program in Canada not too long ago. In less than two years, he did two commercial real estate transactions and made more than 10X the amount he invested in the program.

Most people stop their education as soon as they graduate with a Bachelor’s degree. They fail to realize that most Bachelor degrees don’t prepare you for financial success.

When you stop investing in continuing education, you don’t build the knowledge that is required for success.

You’re too busy at work and distracted by social media that you have no time to read. The majority of people will only read one book per year, thus missing out on an amazing learning opportunity.

You fail to realize that the more knowledge you have, the more competent and confident you will be. The more knowledge you have, the better your decisions. Decisions that can open opportunities for you.

Reading is part of my daily routine. I read and journal every day. I listen to audiobooks as I work out and as I drive. I’m constantly reading and listening to insightful content on topics that help me get better at my game.

You can do the same too. Make learning a priority. Make building knowledge and learning new skills a priority. If you do this every day, you will be a better version of yourself in a couple of months. And you will automatically earn more.

“Personal confidence comes from making progress toward goals that are far bigger than your present capabilities.” — Dan Sullivan

As you grow in your knowledge, you will start to take meaningful action that drives you closer to your long-term goals. As you take action and make progress, your confidence grows. And the more confident you become, the bigger actions you can take.

Investing in yourself is critical. It is fundamental to making huge leaps in your business or professional career.

3. You don’t mind paying too much in taxes

“There may be liberty and justice for all, but there are tax breaks only for some.” — Martin A. Sullivan

Whether you like it or not, taxes affect all of us.

If you earn a decent income, then taxes are by far your largest cost. Yet, you don’t take any action to intentionally manage your taxes.

You give in to the lie that you have no control over the amount of taxes you pay.

You don’t realize that the tax laws reward certain groups of people with favorable tax breaks for engaging in certain activities.

Because you pay no attention, you religiously pay taxes without much consideration.

In fact, you allow the government to take a huge portion of your money upfront before you even see it.

And if you’re a Canadian resident for tax purposes, the more you earn, the higher your taxes.

The point is you must pay attention to how much you pay in taxes. It is critical if you want to keep and grow your money.

A basic understanding of taxes is thus critical to ensure you keep as much of your money as possible. The more money you have, the more you can invest to grow your money.

There is absolutely nothing wrong with paying taxes. In fact, we must pay taxes to maintain the amenities we have. But, you don’t have to pay more than your fair share of taxes.

4. You don’t model what works or what successful and rich people do

“Success leaves clues.” — Unknown

You think you know it all.

You think you will be the next great inventor.

There is nothing wrong with thinking like this. But, you must realize that whatever you want to do would have been done already in one form or another.

So, save yourself time, money, and painful experiences by looking for those that have gone before you. Look for those that have achieved the same thing you’re looking to achieve and model them.

I made the same mistake of trying to figure things out myself and wasted so much time and money along the way.

For a long time, I hesitated to work with coaches and mentors. I did not invest in mastermind programs early on to surround myself with high achievers. And I paid for this in time, money, and painful experiences.

If you want to be a great digital marketer and online business guru, model people like Ryan Deiss, Russell Brunson, and many other great minds in the online business space.

By modeling successful people, you will duplicate the extraordinary results they have achieved in their own businesses.

When you invest in a coaching program offered by someone that has achieved the extraordinary results you’re looking to achieve, you will have access to their knowledge, their thinking patterns, and you can learn from them directly.

There are so many ways to model. Here are some ideas to consider:

- Read biographies of successful people. Study people you admire. Read their articles. Watch their interview clips. All of these will inspire you to keep pushing towards your goals.

- If you know people that have the personality traits you admire, look for them and spend time with them. By doing this you will develop those skills and traits. As much as you can, make sure you are never the smartest person in the room.

- One reason why we never learn is ego. Often times, the smartest people are not usually the most successful because they have too big of an ego. They think they know it all. Never put your ego in front of learning something new. You must realize that there is always something to learn from other people.

- Get a coach. Find someone that has achieved exactly the same thing as you want to achieve. Ask them to coach you. This is one of the best ways to achieve great results in the shortest time.

- Join a mastermind group. A mastermind group is a group of high achievers with similar goals. It may be a group of business owners or a group of marketing agents. These groups often meet regularly and they share ideas and experiences that can help you grow.

5. You are unaware of your money mindset

“Money is only a tool. It will take you wherever you wish, but it will not replace you as the driver.” — Ayn Rand

A money mindset is your unique and individual set of core beliefs about money and how money works in the world.

It is your overriding attitude about money.

It shapes what you believe you can and cannot do with money, how much money you believe you’re allowed, entitled, and able to earn.

It shapes how much you can and should spend, the way you use debt, how much money you give away, and your ability to invest with confidence and success.

If you don’t know your money mindset, it may be very challenging to make money. So, given the powerful impact, your money mindset has on your relationship with money it is important to understand your money mindset.

When it comes to money mindset, there are two extremes — Scarcity/Lack and Wealth/Abundance.

Most of us will fall in between these two extremes.

If you think money is a scarce commodity, you’ll feel stressed and anxious. You won’t be generous.

On the other hand, if you think that there is enough money to go around, you’ll feel calm, positive, and optimistic. You’ll openly share and be more generous.

One suggested approach for uncovering your money mindset is to test yourself by marking True or False to the following statements:

- I’m no good with money

- I always make the wrong money decisions

- I’m financially learning disabled

- I’m no good with numbers

- Money can’t buy you love

- Money makes the world go around

- Rich people are snobby and shallow

- Poor people are hardworking and noble

- There’s a limited supply of money in the world

This exercise along with many other ideas can help increase your awareness of your money mindset.

6. You pay no attention to the return on your time

“The key is in not spending time, but in investing it.” — Stephen R. Covey

This concept of looking at the return on your time requires you to look at the time you spend as an investing activity.

You can spend time on useful and useless things. But if you call it “investing”, you’ll definitely invest it in something that has value. Something that is important to you.

So, you must choose your goals wisely so that time you spend on them becomes an investment, not an expense.

Often times we forget that time is money. As a result, we don’t always pay attention to how we spend our time.

“Time is money.” — Benjamin Franklin

In the past, I never attached a lot of value to my time and how I spent my time. Now, I value my time more as I know lost time can never be recovered. Although I make mistakes from time to time with managing my time, I’m more conscious of it now than I’ve ever been in the past.

You have to look at time with the concept of opportunity cost. This means each choice you make with your time has its cost. If you take action quickly, you will achieve results faster. If you delay, it will lead to a decrease in output that will cost you.

You should constantly be looking for ways to save time by automating repetitive tasks, delegating, and outsourcing certain tasks.

If you’re struggling to find a solution for a project or task you’re working on, you can hire an expert to help you. Rather than wasting hours trying to figure stuff out, get someone that can do it in less time and even better.

As an entrepreneur, I struggle with this as most entrepreneurs do. Often, we waste time trying to figure out how to do stuff when someone else can do it faster and better.

So, get in the habit of always thinking of the “Who” rather than the “How”. Find other capable people that can help you accomplish a task rather than wasting time trying to figure it out yourself.

By regularly assessing how you spend your time, you may find the following as examples of things you can cut out of your life to save time:

- Events/conferences and social gatherings that don’t inspire and add value to your long-term vision

- Social media is an addictive waste of time and energy

- Checking your messages and emails every time your phone beeps

- Picking your phone every time it rings

- Excessive addiction to news media

- Doing chores you don’t enjoy when you can pay others to do them

- Watching excessive TV

- And many more that I can’t list here…

“Time is free, but it’s priceless. You can’t own it, but you can use it. You can’t keep it, but you can spend it. Once you’ve lost it you can never get it back.” — Harvey Mackay

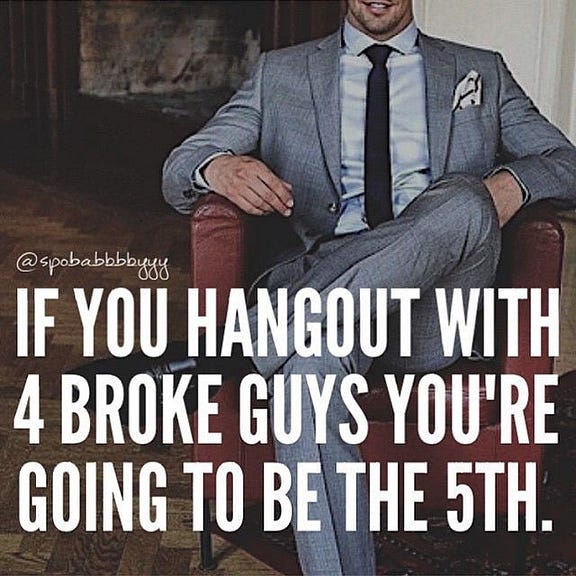

7. You always hang out with broke people

We are all familiar with the famous quote.

“Show me your friends and I’ll tell you who you are.”

It is true.

If you hang out with broke people, you will be broke. If you hang out with rich and successful people, you will be rich and successful.

Dan Peña (a.k.a. the trillion-dollar man) has a similar expression.

“Show me your friends and I’ll show you your future.”

Dan makes a point that if your friends are losers, then you should dump them on the scrap heap where they belong. They will only drag you down to their level if you continue to hang out with them.

Of course, Dan has an extreme viewpoint on this. He openly admits that he has no friends. He sees people as a steppingstone to his life goals.

You may not be that extreme.

There is nothing wrong with keeping friends, particularly friendship that has been built over a long period of time. Good friends will serve many other purposes other than helping you advance your business or career goals.

The point here is that you should seek to hang out with people who force you to level up.

Have you heard the expression…

“If you’re the smartest person in the room, you’re in the wrong room”

Rich and successful people seek out people who are smarter than they are. They are always looking for smarter people to learn from.

If you consider the relationships you have and the people you hang out with, what’s the discussion like?

Do they talk about what they are learning or experiencing?

Do they talk about intellectually stimulating topics?

Do they talk about the challenges they’ve conquered in business or in life?

Do they discuss strategies on how to be a better you? How to be more effective and efficient?

Conversations like this will reveal the kind of people you hang out with.

Conclusion

Next time when you hear yourself say “I’m broke”, read this article.

When someone you know complains that they are broke, share this article with them.

Now, you have what it takes to get the results you want. You have what it takes to make all the money you want.

So, go for it!

P.S. I am on a mission to arm you with financial education. That’s one reason I started writing on medium and that’s why I wrote Tax-Efficient Wealth. This book will help you accelerate your wealth in a tax-efficient way. Grab a FREE eBook version of my new book, Tax-Efficient Wealth, to learn how you can build wealth quickly using strategies that will save you a ton in taxes.