What you can learn from a diversified crop of personal finance experts

In a time such as the one we’re currently living in, finding a money hack can be a great thing. And the best way to do that is to follow the experts who write regularly about money and share their insights.

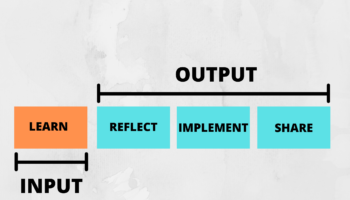

It’s about building knowledge and putting that knowledge into action to create financial transformation.

NextAdvisor, in partnership with TIME Magazine recently created a free resource to help you make smart money moves that can create a big impact on your wealth. As part of this partnership, they recently profiled a diversified group of 10 money experts that are worth following.

As you may know, when it comes to personal finance, it is personal. There are many universal truths, but these truths cannot be blindly applied to every situation. So, that’s why it pays to diversify the information you’re getting and hear personal points of view from others.

These crop of personal finance experts featured by TIME are using their platforms to do just that. They are sharing stories of how others are achieving financial freedom via a variety of ways.

Here is a brief highlight of these 10 pros and why you might want to consider following them. For more details, check out the TIME Magazine story on these experts here:

- Danetha Doe is a Jamaican-Ghanaian money mentor, writer, entrepreneur, and the creator of Money and Mimosas, a financial well-being resource and social club for influencers, bloggers, and creatives. Her mission is to elevate the self-worth and net worth of women.

- Jully-Alma Taveras, aka Investing Latina, shares personal finance tips and tricks through her social media platforms. She’s also a contributor with NextAdvisor. In a recent article, Jully writes. “It’s about being intentional with your spending, clear about your financial goals, and mindful about your consumption.”

- Tiffany “The Budgetnista” Aliche blogs about personal finance for The Huffington Post and her Budgetnista Blog. She’s the co-hosts of the podcast show “Brown Ambition,” and she created an online school, the Live Richer Academy, that teaches women how to create and implement a personalized financial plan.

- Rebecka Zavaleta is the co-founder of Finance Snacks. A platform where they make personal finance advice bite-sized and accessible for their family, friends, and community.

- Nathalie Figueroa is the co-founder of Finance Snacks . Nathalie and Rebecka met while studying at the University of Pennsylvania, and they immediately connected over their passion for making wealth creation actionable and accessible. Finance Snacks was born after they realized they were both unhappy with the financial state of their communities.

- Farnoosh Torabi is a personal finance author and expert and host of the “So Money” podcast, which features candid money conversations and strategies from well-known entrepreneurs, authors, and celebrities. Torabi launched a special series of “So Money” episodes in June called Black Wealth Matters, featuring Black thought leaders and experts from Queen Latifah to business coach Rachel Rodgers.

- Suze Orman, one of America’s most recognized personal finance experts, is a certified financial planner, television personality, and author now hosts a weekly podcast called “Women and Money,” which speaks primarily to women on a wide range of personal finance topics, from the emotions of money to how to prepare for the costs of health care in retirement.

- Erin Lowry helps millennials “get their financial lives together” by offering advice on how to make more money, get out of debt, and build savings. Through her “Broke Millennial” blog, books, lectures, and workshops, Lowry tackles questions like whether you should share personal financial information with your partner and how to manage student loan debt after college.

- Ramit Sethi is a New York Times best-selling author and founder of iwillteachyoutoberich.com, which focuses on strategies for investing and earning more. Sethi doesn’t believe in saying “no” to spending on everything, so he won’t shame you for buying lattes or avocado toast. Instead, he encourages big-picture thinking — moves like getting a raise or starting a side hustle that can have a transformational approach on your wealth.

- Jill Schlesinger is a certified financial planner and Emmy-nominated business analyst for CBS News. She regularly appears on CBS radio and TV stations across the country and is the host of the “Jill on Money” podcast and nationally syndicated radio show. Schlesinger has a talent for breaking down complex personal finance ideas and topics into understandable, relatable themes. She not only tells you what you’re doing wrong and how to fix it — she tells you why, too.

Final Thoughts

Now you have a dose of personal finance advice from a variety of experts. Follow them, learn from them, and get ideas that you can implement in your life to transform your financial journey for good.

P.S. I am on a mission to arm you with financial education. That’s one reason I started writing on medium and that’s why I wrote Tax-Efficient Wealth. This book will help you accelerate your wealth in a tax-efficient way. Grab a FREE eBook version of my new book, Tax-Efficient Wealth, to learn how you can build wealth quickly using strategies that will save you a ton in taxes.