“Next to being shot at and missed, nothing is quite as satisfying as an income tax refund.” — F.J. Raymond

When it comes to taxes, the term “income” isn’t quite as straightforward as you might think.

In Canada, there are four main distinct groups of income you may have as an individual with a variety of different tax implications. In some cases, you may have sources of income with zero tax!

So, understanding this and arranging your affairs accordingly will enable you enjoy tax breaks that most people don’t know about. This is why I love this quote by Martin Sullivan.

“There may be liberty and justice for all, but there are tax breaks only for some.” — Martin Sullivan

Below are the four main groups of income in Canada:

1. General income

This includes income from employment, self-employment, sales commissions, tips and gratuities, pensions and other social benefits, interest, etc.

General income sources are taxed the most heavily in Canada.

2. Dividend income

This is dividends paid to company shareholders. Dividend income receives a special deduction that can reduce the rate of taxation. However, the effect of the deduction varies.

3. Capital gains income

This is the income you make by selling shares or other property, which are taxes on only half the profit made on the sale (except your home, which is exempt from tax when it is your principal residence).

4. Tax-free income

Yes, there is such a thing as tax-free income.

This includes income from insurance, income from sale of your principal residence, gaming and gifts, which are generally tax-free (except gifts from your employer, and some gifts of capital, such as company shares — if the gift produces income, then the income is usually taxed).

In Conclusion

Note that general income sources are taxed the most heavily in Canada.

Dividend income and Capital gains income attract lower taxes compared to General income.

The best part is that there are certain income sources that are tax-free. In addition to the income sources included in this tax-free income group listed in #4 above, proceeds from loans such as equity from your home or loan from your tax-exempt insurance policies can also be included in this income group.

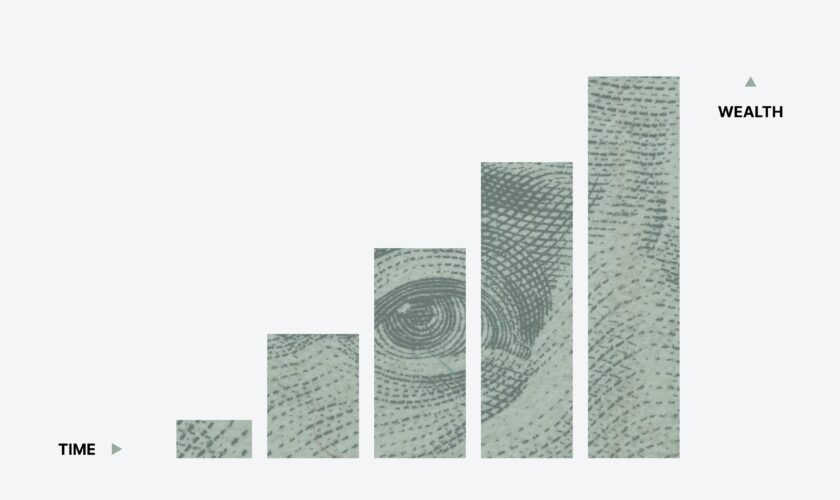

This 4th group of income represents a great source of tax-free income that can be used to significantly accelerate your wealth.

Depending on the type of income you earn, you may end up keeping less or more of your income. So, it is key to understand this and plan accordingly to structure your income to keep more of your money.

“The best things in life are free, but sooner or later the government will find a way to tax them.” — Anonymous

Note that every dollar saved in taxes will help accelerate your wealth.

Before you go….

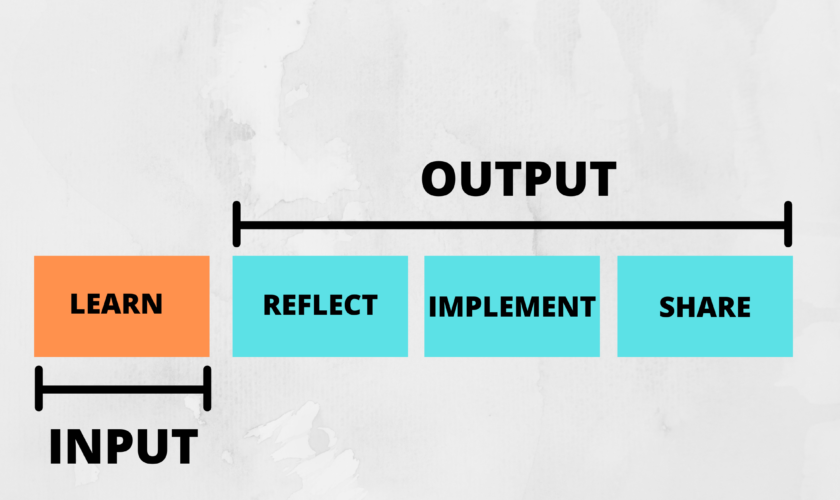

If your goal is to minimize taxes, I can help! In this short video, I share more about the tax-efficient membership network where our overriding goal is financial transformation. Together, we learn how to build a Tax-Smart Plan that will allow us to:

- Contribute or save money tax-free

- Grow or accumulate money tax-free

- Withdraw or distribute money tax-free

Check out the video here to learn more. And if you have any questions regarding our membership, you can schedule a FREE no obligations call with me here.