If you listen to mainstream media, you will agree that debt is a big topic, particularly household consumer debt. And in many cases, you will find experts hammering on not just consumer debt, but also on all types of debt.

While I totally agree that incurring unnecessarily high consumer debt is a bad idea, I don’t agree that all debt is bad. Using debt or financial leverage will allow you to build financial freedom faster. It will allow you to shrink time. The key is wise leverage. If used correctly, it has the potential to increase your wealth and improve your life. If used unwisely, it will burn you.

To leverage the use of debt appropriately, you have to manage the risk that debt introduces and one way to do this is to manage the risk with a financial reserve from a solid base of income-producing assets.

Let me explain.

There are 3 steps involved here:

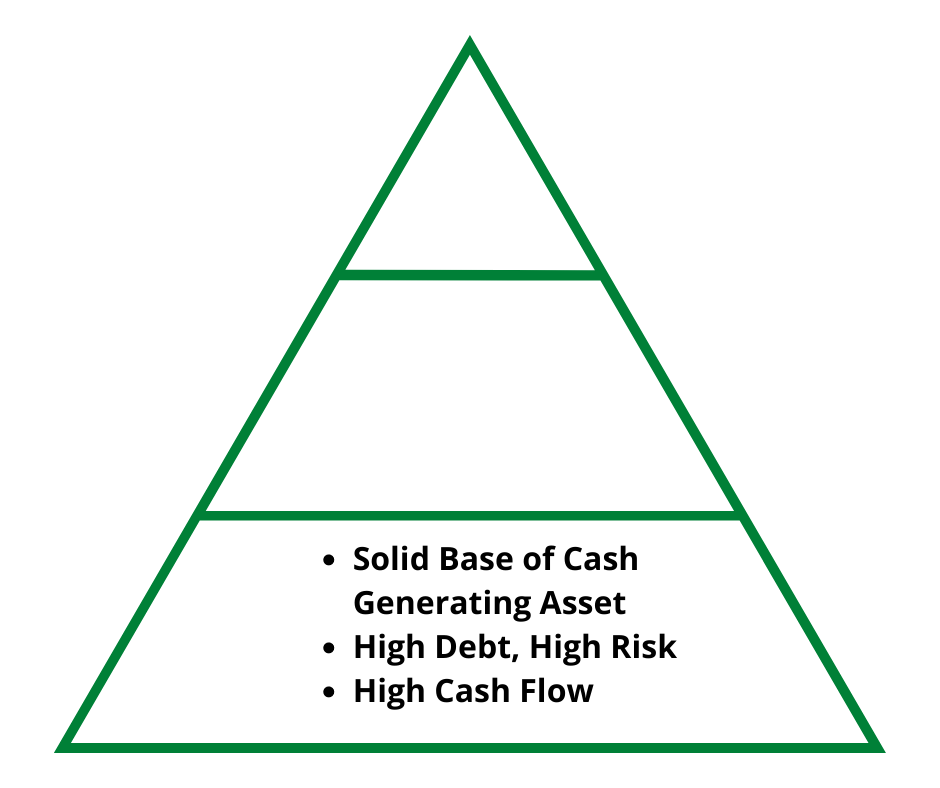

Step 1: Build a Solid Base of Cash Generating Assets with Debt

Here, you want to buy a solid asset that has the potential to increase in value over time and an asset that can generate good monthly cash flow. This step will require you to take the highest amount of debt. To reduce the risk that this debt introduces, you have to buy an asset that will generate great cash flow on a monthly basis. A good example here may be acquiring a 20-unit residential building or building a portfolio of rental real estate over time as I’ve personally done over the last 10 years.

With the high real estate prices in Toronto and the Greater Toronto Area, you will require a lot of capital to do this step. However, you can start small by buying a starter home, and over time, you will build a portfolio of income-generating assets.

Now, you take the cash flow generated from this asset, accumulate it, and move to step 2.

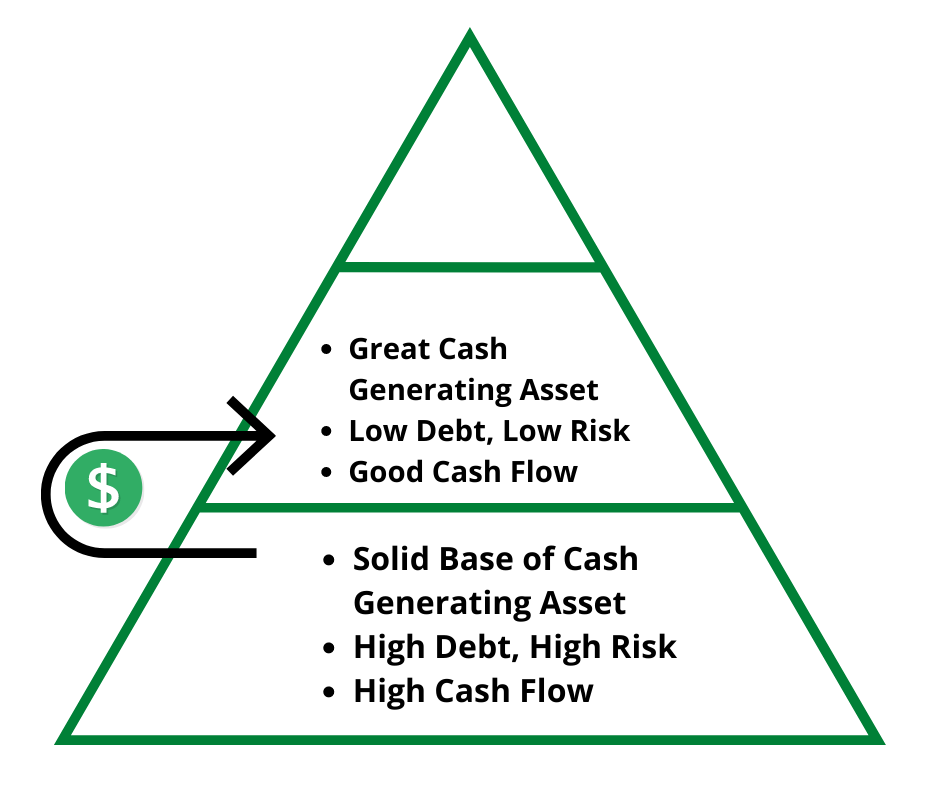

Step 2: Buy Another Cash Generating Asset with Little or no Debt

Here, you take the accumulated cash flow from the first asset base to buy another asset. To successfully do this, you will have to be disciplined to save and accumulate the cash flow from Step 1. This means you need to have other sources of income to maintain your lifestyle, e.g., keeping your current job, running your existing business, or starting a side hustle.

A good example of an asset that will make sense for this step may be a small condo in a small city that you may get for less than $200,000. Or a manufactured or Trailer home you can buy for less than $50,000. Another example may be taking a position in a small and stable small business.

The idea here is to acquire the asset with little or no debt. As the debt here is way less than the debt in Step 1, the risk is significantly reduced. And because you have little or no debt payment, you will still generate a good amount of cash that may only be slightly less or even more than cash generated from Step 1.

After you acquire the second asset in Step 2, you now have two assets generating cash flow. The next step is to take the cash flows from both of these assets and go to Step 3.

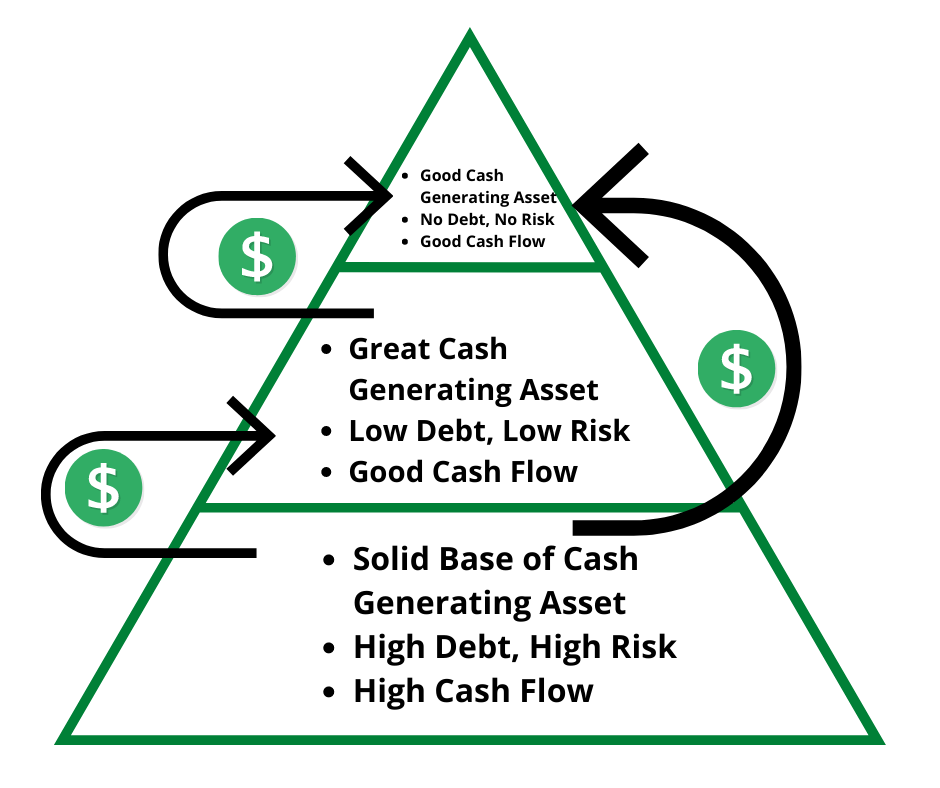

Step 3: Buy A Third Cash Generating Asset with no Debt

In this final step, you take the combined cash flow from both assets acquired in Steps 1 & 2 and acquire additional cash flowing asset(s) with no debt. A great example of an asset here is a dividend-paying stock. You can acquire these assets at a much cheaper price compared to assets in Steps 1 & 2 and you can acquire them with no debt.

Since you’re buying these assets with no debt you eliminate the associated risks that debt adds. Obviously, you have to do some research to ensure you’re buying dividend stocks of great companies. These companies should serve a need that is essential in the marketplace, should have a great record of consistently paying dividends, and should have the potential to grow.

Notice that in all steps, one thing that is common with these assets is that they all generate cash flow. This is important as the cash flow is what enables you to acquire additional assets.

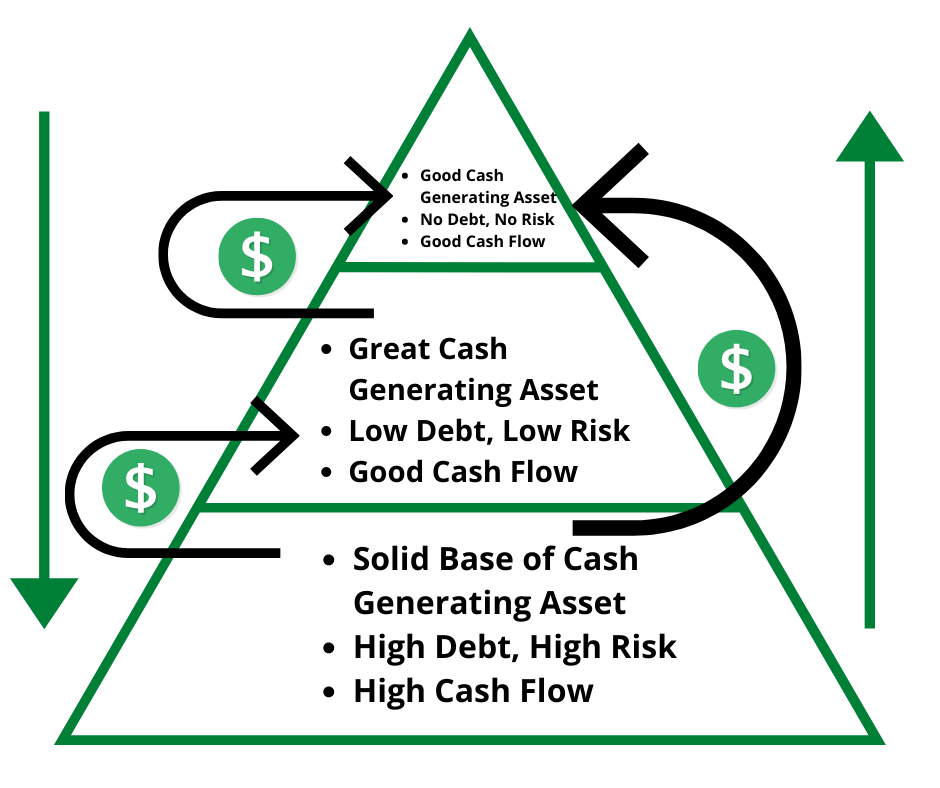

So, how does this help with risk management?

As you go up the pyramid, your risk reduces as you reduce and eliminate debt. Now if you encounter a bad situation triggered by a bad economic situation or other events that impact your cash flow with the assets at the base, you have cash flow from the other assets that can be used to continue to meet your debt obligations. The last thing you want is to be forced to sell an asset during an economic crisis. So building other assets with little or no debt a great way to manage this type of risk.

Final Thoughts

The great thing with this idea is that you have the flexibility to customize this plan based on your current situation. If you don’t have a significant amount of cash today required to start at the base of the pyramid, you can start at the top (Step 3) and walk your way down. You can start at Step 2 and move up or down as you accumulate more cash. You can start anywhere.

Action Steps:

- Consider how you can make modifications to your current plan to incorporate these ideas so you can build more cash flow generating assets and mitigate risk at the same time

- If you don’t have a plan like this, consider starting one today!

P.S. I am on a mission to arm you with financial education. That’s one reason I wrote the book, “Tax-Efficient Wealth”. This book will help you accelerate your wealth in a tax-efficient way. Grab a copy of the book here, to learn how you can build wealth quickly using strategies that will save you a ton in taxes.