“I am not afraid of tomorrow, for I have seen yesterday and I love today.” — William Allen White

Fear is a major hindrance, not only in business but also in all aspects of life.

In your professional career.

In sports.

In raising your family.

And in your faith.

Although fear has a negative connotation associated with it, we must recognize that fear is a necessary part of life. In fact, fear is one of the major contributors to progress and development in our world today.

The fear of dark and wild made fire important. The fear of invasion led to the building of the Great Wall of China. And the fear of death and misery helped in making medical advancements.

With this in mind, it is the way we react to fear that makes the difference. It can hinder us or it can trigger success and victory.

Fear often prevents us from taking risks or from trying new things. By our nature, we like to do what we’re comfortable with. As an accountant, it’s worse as my tendency is to be super conservative, often hesitating to take risks.

As I look back and reflect on my journey, fear hindered me in many ways. I have also pushed past my fears in other areas and achieved great success.

What I’ve realized over the years is that these fears never go away. Rather, we grow in our experience in how we respond to them.

As individuals, we deal with different types of fear. Your fear may be my playground and my fear may be your strength. For me, here are the top five fears that show up regularly in my business ventures.

#1 Fear of Failure — Not going all-in

“Instead of worrying about what people say of you, why not spend time trying to accomplish something they will admire.” — Dale Carnegie

Almost eight years ago I started a professional accounting firm with two other business partners. One partner worked full-time in the business. Another partner and I worked part-time in the business while we maintained our full-time day jobs.

This arrangement allowed us to keep most of the cash from the business reinvested in the business. However, it hindered growth as there was less commitment to focus on client service, business development, and other aspects of the business.

As I look back, the primary reason why I did not go all-in was fear of failure.

I did not want to deal with unbearable embarrassment from family and friends. I did not want to risk losing the steady salary that came from my full-time job.

As I transitioned to the business full-time, I struggled as I now had to face my fears with both feet in.

Although there was growth, the fear of failure kept rearing its head. As a result, I could not commit full-time. I continued to seek contract roles in the corporate world that distracted me from focusing on the business.

Unfortunately, these distractions never end. They show up in various forms and continue to slow growth in the business. Now, I’m more aware of this fear. And I’ve developed other income streams as plan B to address this fear.

Generally, when we think of failure, we think of painful embarrassment and the anguish of losing everything. But we must realize that fear of failure is often rooted in pride.

If we fail, we believe that all those who doubted us will have been right. Should we care about this? No. Instead, ask yourself these two questions:

5 or 10 years from now, will you regret not taking this opportunity?

And if you do fail, what is the worst that will happen?

Coming up with a backup plan, a plan B, will give you the confidence to push past your fears. And if it doesn’t work out, learn from it and try something else.

#2 Fear of committing to business expenses — not finding funding

“Everything you want is on the other side of fear.” — Jack Canfield

Fear of not securing financing is a major reason many people don’t get started in business or invest in growing an existing business.

Early on, we were lucky to get a business line of credit to finance our operations.

As we grew, we made a decision to hire a new employee. We needed more operational capital to support this but our bank declined our request for an increase in our credit line.

This did not stop us from hiring even though we were not sure if we will have enough cash flow to pay salaries and associated business expenses.

In spite of this, we confronted this fear and went forward to hire the new staff. We figured there’s no way we can move the business forward without making this kind of financial commitment.

We’ve consistently confronted similar challenges like this. We bought a new office unit, hired additional employees, and took on additional expenses in the business.

In making these decisions, we’ve not allowed the fear of how we will deal with the additional expenses in the future hinder what we believed was the right business decision for our firm.

If you’re starting a business, committing to expenses is a risk. This risk can often lead to fear that can hold you back, but unless you’re willing to invest in your dream, your business may never take off.

#3 Fear of not attracting customers

“I learned that courage was not the absence of fear, but the triumph over it. The brave man is not he who does not feel afraid, but he who conquers that fear.” — Nelson Mandela

In an industry that is commoditized, it was terrifying for us to take the risk of starting our business. We wondered if anyone will value our skills and service offering.

If we lived in this fear, we would never have started.

What we’ve learned over the years is that as we approached our business with confidence and delivered what we promised, we’ve undoubtedly experienced the joy of serving more and more clients who value our services.

These clients were happy to refer other customers to us.

So don’t let this fear hinder you. Instead, focus on your marketing plan. Focus on increasing your level of expertise, and focus on consistently delivering on your promise to your clients.

#4 Fear of not earning enough to recover the investment in the business

“Do the thing you fear to do and keep on doing it… that is the quickest and surest way ever yet discovered to conquer fear.” — Dale Carnegie

Don’t quit because you don’t see an immediate return on your investment. If we wanted an immediate return, we will be out of business by now.

In fact, after the first 5 years, if I calculate my return on investment, it will be minimal at best. I would have been better off investing in mutual funds.

In business, you need to have a long-term perspective and this should keep you working, even when you don’t see an immediate return.

For some, it may take 5 years or less. For others, it may be 20 years or more. No matter how long it takes, stay focused, and keep working!

#5 Fear of change — trying new services, new ideas, and new markets

“Don’t fear failure so much that you refuse to try new things. The saddest summary of a life contains three descriptions: could have, might have, and should have.” — Louis E. Boone

There is a rapid change in our market, particularly with the changes in technology and client expectations. As a result of this, we must be agile to succeed in today’s marketplace.

As accountants, we are particularly vulnerable to the fear of trying a new service, new technology, or going to a new market.

It is easy to stay stuck in doing what we’ve always done even when the world around us is changing at a rapid pace.

As a firm, we have committed to continuously exploring new ways to serve our clients. Including offering new services and trying new technology that will enhance service delivery.

Fear of change makes us anxious about the future, and this will certainly lead to a closed mindset in which we fail to anticipate what’s coming next.

As the popular saying goes, change is inevitable. You can’t avoid change forever.

No matter what stage you’re at with your business, you’ll have to find ways to embrace and harness new ideas, technology, and innovation.

In Conclusion

“Remembering that I’ll be dead soon is the most important tool I’ve ever encountered to help me make the big choices in life. Because almost everything — all external expectations, all pride, all fear of embarrassment or failure — these things just fall away in the face of death, leaving only what is truly important.” — Steve Jobs

As a business owner, you must recognize that risk is all around you.

In fact, life is a series of calculated risks.

Everything you decide to do has a margin of risk so be bold and face your fears head-on.

John F. Kennedy said it best in this quote:

“There are risks and costs to action. But they are far less than the long range risks of comfortable inaction.”

I hope you have found this helpful. Best of luck with your business or professional career!

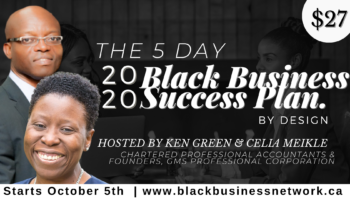

P.S. If you’re looking for an amazing business opportunity providing a service that is growing in demand that will start generating guaranteed cash flow in a short period of time, check out this opportunity here that we’re currently offering.