The story of how we moved from debt to a savings rate of nearly 50%

It was Friday evening, I had come back from a busy workday.

As we got ready for dinner, my wife said, “Ken, can we talk after dinner?”

Trying to hide my nervousness, I said “sure”.

I’m always anxious when my wife calls me by my name. Often, she calls me “baby”, the same name that I call her. And I get even more nervous when she wants to talk. It often means there is something wrong.

Most times, I can sense it. This time, I figured it was a financial mess I had gotten into.

For many years, my focus was always on making more money, thinking that this will solve all my money problems.

While I desired financial freedom, I had no idea what it meant or what was required to achieve financial freedom.

As I focused on making money, I paid little attention to cutting my expenses and paid no attention to my net worth.

Although my income was increasing every year, my expenses were also growing. So, I did not make progress. In fact, it seemed worse.

My credit card was maxed on consumer debt. When my wife opened the credit card statement that came in the mail, she was shocked and so…

She called a meeting.

I was ashamed as she lectured me on basic money management. She wondered why I was okay carrying a high credit card balance at 28% per annum.

I had betrayed her trust. It made me feel sick. I felt like a total failure.

I was disappointed in myself. I should have known better managing my spending. After all, I have an MBA (Masters in Business Administration) and I am a Chartered Professional Accountant. I had a strong educational background in finance. So, I should have known better.

As I stared on the floor during our conversation, I made a vow that this will never happen again. But it did. Not once. Not twice. Multiple times.

Sometimes, I would justify it.

It is my money.

You keep your money, and I will keep mine.

It is my debt.

Don’t worry, I will pay it off.

It is this same narrative that has led to many broken marriages. It is the same money story that has destroyed many homes and continues to wreck many families today.

When I first met my wife, I had worked for nearly 5 years and had no money saved.

Can you imagine that?

After 5 years of working at a decent job, I had nothing to show for it. ZERO!

I was certainly heading for a financial disaster.

But, I was lucky. Absolutely lucky because my wife saved me.

Early in our professional career, we came up with a brilliant idea. I would take care of all the expenses at home, and she would save the majority of her income.

I no longer had money to spend. I no longer had money to give away.

Each month, I struggled to keep up with mortgage payments, property taxes, utilities, gas, car maintenance, and other household expenses.

Often, I would go into debt just to keep up with the expenses. The debt will grow each month. And I will pay it off as soon as I get my annual bonus. Then the circle continues again, and again, and again.

Without knowing it, this arrangement allowed us to substantially increase our savings rate to nearly 50%.

We increased this even further by maximizing all work-related matching programs. By doing this, we had more money taken at source and invested in RRSPs and in the company’s stocks.

As we learned about real estate investing, we started investing in real estate. When it was time to pay the hefty down payment, my wife will show up with all the money.

I was always in shock. I would ask her, “how did you manage to accumulate so much money?”

This strategy worked for us. It allowed us to continue to invest more and more in rental real estate.

As I learned about the dangers of consumer debt and the fact that it is non-deductible for tax purposes, I began to slowly eliminate consumer debt. At the same time, I learned that debt incurred to generate income can be deducted.

So, as I ventured into business, I had no hesitation to incur business debt. After all, it is deductible. If I have a business credit card debt at 28%, the effective interest rate after considering taxes is approximately 24%.

It was easy to justify incurring debt for business purposes. While this is far better than consumer debt, it is often not the most effective way to run a business.

As an entrepreneur, I don’t hesitate to take risks or take on debt to pursue a great business opportunity. It’s a tendency that certainly needs to be kept in check if you want to manage debt and save at the same time.

So, given my inability to save on my own, I set up automatic withdrawals from my business account to a locked-in Retirement Savings account. I figured that if the business fails, I will have something to show for it.

So, why am I sharing these stories?

It’s because your ability to save and constantly increase your savings rate is critical for your financial well-being.

In his blog article titled “The Shocking Simple Math Behind Early Retirement”, Pete Adeney provides a correlation between savings rate and years until financial independence.

With a 5% savings rate, you will need 66 years of savings to be financially independent. With 20%, 37 years, and with a 75% savings rate, you will only need 7 years.

Often, we focus on making more money but forget about cutting expenses and investing in a tax-efficient way.

“Financial peace isn’t the acquisition of stuff. It’s learning to live on less than you make, so you can give money back and have money to invest. You can’t win until you do this.” — Dave Ramsey

One reason we struggle with savings is our inability to delay gratification. When our goal of saving money is not high enough to delay the purchase of the latest smartphone, kitchen counter, new car, or new furniture, we spend. And often, we spend beyond our means.

For those that save, we don’t seem to make progress because our savings rate is low. Often, equal to or less than 10% of our gross earnings.

To make significant progress, you have to increase your savings rate to 30% or more. Increasing your savings rate is partly related to your budget, but spending less is 80% behavior and 20% math.

Remember, the reason I encourage you to increase your savings rate is not just for the sake of saving. Rather, it is to enable you to invest in assets that will allow you to accelerate the growth of your wealth.

“If you would be wealthy, think of saving as well as getting.” — Benjamin Franklin

In an earlier article, I discussed 11 tips that can help you reduce expenses and increase your savings rate without impacting the quality of your life.

In Conclusion

“It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.” — Robert Kiyosaki

Maximizing the savings rate is not quick. It takes time and it requires great discipline.

But it is the most reliable way to begin the process of wealth accumulation.

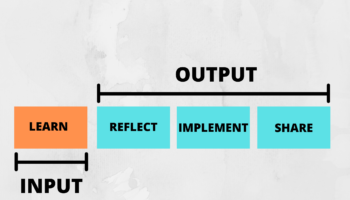

P.S. For 5 days starting on July 6, I will be sharing all I’ve learned about personal finance. I will show you how you can move from a place of uncertainty in a time such as this to a place of confidence and certainty with your finances.

This will be a different learning experience as you will have the opportunity to ask questions, work on implementing what you learn each day, and actually get some great results at the end of the 5 days.

Also, I will give you my brand new book, TAX-EFFICIENT WEALTH as a thank you for joining.

Join the Challenge here and get a FREE eBook version of my new book!