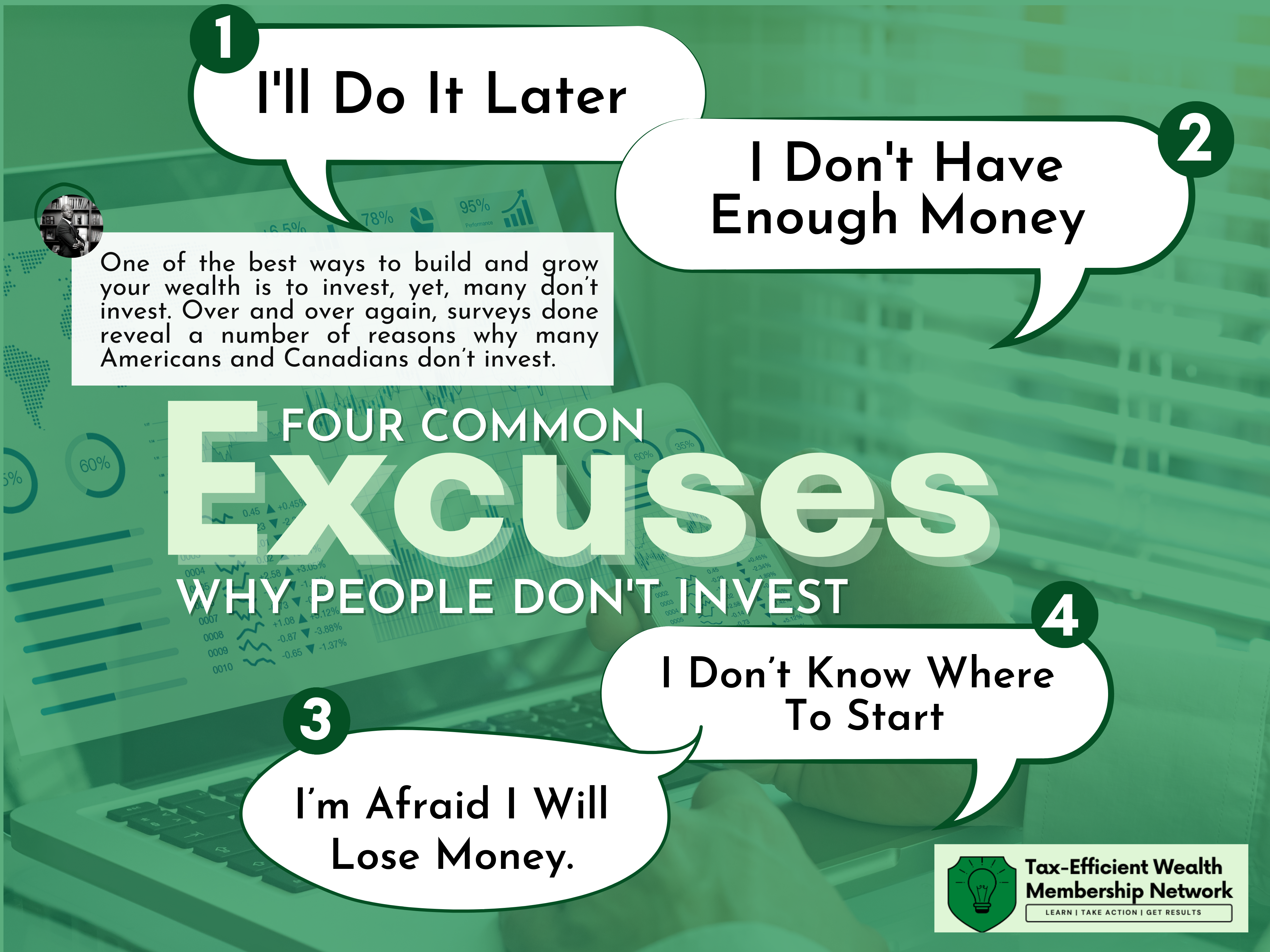

One of the best ways to build and grow your wealth is to invest, yet, many don’t invest. Over and over again, surveys done reveal a number of reasons why many Americans and Canadians don’t invest. For some, it’s a fear of taking losses. For others, it’s the feeling they don’t know how and/or that they don’t have enough resources to invest. Unfortunately, it appears there is a misconception out there that you need to be an expert with a lot of money to start investing.

For those with regular jobs, I can understand some of these reasons. If you’re employed and you’re used to getting paid regularly, it can certainly be challenging to start investing. You have to make the shift from an employee mindset to an investing mindset, which can be very challenging, particularly if you know little about investing and you’re not comfortable taking on risks.

Many people confuse saving with investing. In some cases, both can mean the same thing and can be interchangeable. Maybe, we should start by discussing the difference between saving and investing. It’s possible to save and not invest. However, it is hard to invest without saving.

Saving is the act of putting away money for a future expense or need. When you choose to save money, you want to have the cash available relatively quickly, perhaps to use immediately. However, saving can be used for long-term goals as well, especially when you want to be sure you have the money at the right time in the future.

Investing is putting your money into something specific with the expectation that its value will grow over time, providing you with the opportunity to create more wealth. Investing is similar to saving in that you’re putting away money for the future, except you’re looking to achieve a higher return in exchange for taking on more risk. Typical investments include stocks, bonds, mutual funds, and exchange-traded funds, or ETFs. You’ll use an investment broker or brokerage account to buy and sell them.

In this article, I will be referring specifically to investing. Below are the top 5 common excuses why most people don’t invest:

Excuse #1: I Don’t Have Enough Money

In a recent survey by GoBankingRates, 55% of Americans are not investing because they think they don’t have enough money to invest. They simply can’t find room in their budget to invest. Others simply assume that only the rich can invest but forget the fact that most people BECOME rich by investing. This belief that you need a large income or a large amount of money to start investing is a misconception.

Many find it hard to start investing probably because most experts recommend a savings rate of at least 10 percent. That number can be hard to swallow for those living paycheck to paycheck. And this alone can be discouraging for most to even start the process of saving. Remember, if you can’t save, you can’t even invest because you will have nothing to invest.

How do you address this and start investing today?

Note that it is OK to start small — even if it’s saving only 1 percent of their income and then investing that in something you understand.

If you understand the goal of investing as defined earlier, it is putting money into something specific with the expectation that its value will grow over time, providing you with the opportunity to create more wealth. My personal opinion for those starting this journey of investing is to start by investing in themselves. I believe you represent the ultimate economic value to yourself and to those you support and serve.

As such investing in yourself will yield the ultimate return. When you invest in yourself to learn the mindset required to invest successfully, and to learn the game, you can start investing small or big depending on how much you can save. In fact, you will come to realize that investing is the smart thing to do no matter your current income level.

Excuse #2: I Will Invest Later

This is a common reason, but underneath this is fear, particularly for older folks. Fear often leads to procrastination.

Fear that you don’t know how to invest.

Fear that you will lose money when you invest.

Fear that your lack of knowledge will be exposed.

Fear of simply taking action and stepping out of your comfort zone.

For young people, the data suggest that most of them think that the right time to invest just hasn’t arrived yet. They either think you need to be at a certain age to start investing or you need to have a certain income level or need to have a few other things lined up first before investing.

It’s never too late to start investing, but it is very easy to let a lack of understanding push you to keep putting it off.

One of the easiest ways to combat this excuse is to arm yourself with knowledge and surround yourself with accountability. That accountability may be in the form of being a part of a small group of investors or hiring a coach or a mentor to guide you in your investing journey.

Excuse #3: I Don’t Know Where To Start

Even though we live in an information age where there has never been a more easy access to information than any time in history, many still consider a lack of knowledge as an excuse for not investing. Perhaps the real excuse here may be a lack of time to learn or maybe a lack of confidence in your knowledge.

While the survey results show a significant drop in the number of people from the lowest age group (18-24) to the rest saying that they needed more investing education, the proportion of Americans who believe they needed to learn more before they can start investing (over a third of respondents) remains pretty steady from people in their mid-20s to their mid-50s.

Therefore, it appears that the issues with financial literacy and a lack of investing knowledge are not limited to younger Americans but are actually persistent, ongoing issues that can continue to follow people well into middle age and later.

From experience, I think the issue is not the lack of knowledge but rather the lack of confidence in what you know. This lack of confidence is often reflected in how we learn.

To combat this excuse, I suggest you change the way you learn. Rather than just consuming information, shift to experiential learning. This is when you consume information, reflect on the information, abstract the information and then act on it to actually experience it. When you use this type of learning loop, you will find yourself investing in no time and constantly learning from your investing experience.

Excuse #4: I’m Afraid I Will Lose Money

This is a common excuse for many crippled by the fear of investing and this is often linked to a lack of knowledge. Oftentimes, they assume that investing is all about picking stocks or about understanding all the Wall Street or Bay Street jargon like P/E ratios, Market Capitalization, Dividend yield, etc. And they equate investing to gambling. But they don’t realize that investing is way simpler than this and that investing is totally different from gambling.

Gambling is all about luck. It is all about taking a chance. With gambling, you bet something of value, with the consciousness of risk and hope of gain, on the outcome of a game, a contest, or an uncertain event whose result may be determined by chance or accident.

Investing, on the other hand, is the process of buying assets that increase in value over time and provide returns in the form of income payments or capital gains. In the world of finance, investing is the purchase of securities, real estate, and other items of value in the pursuit of capital gains or income.

So, investing is more of a calculated, intentional act to profit. Are there risks involved? Yes. But these risks are often calculated and quantified. I encourage you to learn about the different ways you can invest. If necessary, engage the services of a professional to help you invest and to help manage your investments.

One of the ways I combat these excuses is by using a framework when I assess investment opportunities. If you have a framework, it will streamline your decision-making process when it comes to assessing various investment opportunities.

For every investment opportunity I review, I assess using the following four criteria:

- Growth: Does the investment give me opportunity to grow my money? I look for investments that have the potential to grow in value over time. Investments like real estate that typically grow in value over time is a good example here.

- Tax-advantaged: Will the investment give me the opportunity to save or optimize my tax situation? Here, I look for investment opportunities that come with tax advantages. For example, investing in a business gives me the opportunity to write off a number of expenses which will minimize my taxes. In addition, businesses have low tax rates which will result in lower overall taxes.

- Liquidity: Will this investment opportunity provide me with liquidity when I need it? I look for opportunities that give me the ability to liquidate my investment and take advantage of better investment opportunities. An investment with a great liquidity option allows you to minimize opportunity costs.

- Return on Investments: Will this investment opportunity provide at least 5 to 10% annual return on investment? I look for investments that generate decent annual returns year over year.

For more on this, you can watch the YouTube video on this using the link below: