On Monday, May 31, the Government of Canada announced the launch of the Black Entrepreneurship Loan Fund. The application for this loan is now open and eligible Black business owners can now apply by going to: https://facecoalition.com/en

The Black Entrepreneurship Loan Fund, a component of the Black Entrepreneurship Program (BEP), is a partnership between the Government of Canada, Black-led business organizations and financial institutions. The loan fund is now an investment of $291.3 million to support the success of Black entrepreneurs and business owners.

The fund will provide loans of up to $250,000 to support Black business owners and entrepreneurs across Canada and lay the foundation for future success and long-term change.

Who is eligible under the Black Entrepreneurship Loan Fund?

To be eligible for a loan, an applicant must:

- self-identify as Black or Black-led (majority ownership of >51% by Black Canadians);

- be a legal resident of Canada: i.e. Canadian citizen or permanent resident, or conventional refugee (for microloans only), or a legal entity owned and controlled by a Canadian citizen or citizens; and

- be a minimum of 18 years.

What businesses are eligible under the loan fund?

Eligible businesses may include start-ups and existing for-profit small businesses in Canada. Such businesses can be corporations or sole proprietors and for-profit social enterprises. Businesses must have a business plan, business registration and recent financial statements or financial projections for start-ups.

What is eligible for financing under the loan fund?

Loans can be used for:

- Capital investments–equipment, leasehold improvements, property improvement, office equipment

- Working capital–inventory, payroll, lease payments, accounts management, rent, overhead costs

- Short-term receivable financing (i.e. financing to service a contact)

How much can be financed and what is the maximum loan amount I can access under the Black Entrepreneurship Loan Fund?

The loan fund will offer loans up to $250,000. The Federation of African Canadian Economics (FACE) can provide loans of up to $100,000. Loans above this amount will be risk shared with the Business Development Bank of Canada.

Alterna Savings and Vancity, under the microloan pilot program, will offer loans between $10,000 and $25,000.

Where can you apply for the Black Entrepreneurship Loan Fund?

The FACE loan portal, accessible at Federation of African Canadian Economics (FACE), will act as the electronic and initial intake process for interested applicants. Loan applicants will be able to submit and communicate with a FACE client relationship manager on the progress of their loan request.

For more information, go to the Government of Canada’s web page.

HOW WE CAN HELP

We’ve reviewed the entire application on the FACE application portal and there are approximately 56 questions to answer. The key documents you will need to provide to support your application include:

- Business plan

- Your most recent financial statements for your business

- Your most recent tax return for your business

- Your most recent personal tax return

- A completed personal statement of net worth

So before you apply, consider preparing and organizing these documents so you can complete your application for processing.

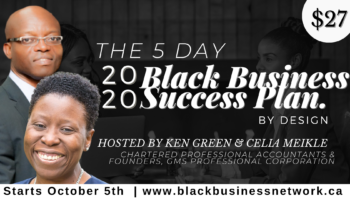

If you require assistance with the preparation of your business financial statements and tax returns, we can help. Simply contact Ken at [email protected]

We also offer business plan services and we have a Business Plan Bootcamp starting soon on June 14, 2021. Only 10 spots available, so check out details below to sign up:

Business Plan Bootcamp – $497 ONLY

This is a 5-Session Business Plan Building Workshop over 14 days. These sessions will provide you with total clarity about your business and will guide you to create your own business plan ready for financing application or other purposes, as required.

We will guide you to build your own business plan over a period of 14 days and we will guarantee it or you get your money back:

- In Session #1, you will define your market (i.e. who you serve) and identify the need (i.e. the problem you are solving)

- In Session # 2, you will design your offering (i.e. your products and services) and design the delivery (i.e. how will you deliver your products and services)

- In Session # 3, you will learn about going to market (i.e. getting your market to know that you exist)

- In Session # 4, you will learn about developing the financial projections for your business; and

- In Session # 5, you will put it all together (i.e. your final business plan)

To learn more, go to: https://www.blackbusinessnetwork.ca/businessplan

We also offer other business plan packages below:

Business Plan Package Option 2 – $2,497 plus HST

This is the most popular package. With this package, you will do some work and we will do the rest. Here are the details:

- You will provide the information on the preliminary research you’ve done – surveys, market research, and other relevant information on the business.

- We will take the raw information you’ve provided and organize them in a professional business plan document. We will make changes as required to ensure the business plan communicates the relevant information you need to run a successful business or information required for financing purposes.

- FREE training on how to set up your business accounting system on Quickbooks Online (QBO), including setting you up on QBO (you will be responsible for the monthly subscription fees, approximately $20 plus HST per month) + 3-month support from us (All sessions will be recorded so you can reference in the future).

Business Plan Package Option 3 – $4,997 plus HST

With this package, we do all the work and we will create your business plan from scratch. Here are some details:

- We will set up a time to interview you to gather information on your business, including information on any preliminary research you’ve done or if this is an existing business, information on the business.

- We will prepare and present you with a professional business plan based on information gathered and our own research.

- FREE training on how to set up your business accounting system on Quickbooks Online (QBO), including setting you up on QBO (you will be responsible for the monthly subscription fees, approximately $20 plus HST per month) + 3-month support from us (All sessions will be recorded so you can reference in the future).

- 50% discount on our fees if you engage us to provide accounting and tax-related services for the first year of your business.

If you have any questions, contact Ken at [email protected]