This week, I’m presenting a 5-Day FREE training on personal finance. Participants will learn the step by step approach required to live in peace with their money and to achieve financial independence.

As part of the FREE training, I’m giving away the eBook version of my new book, Tax-Efficient Wealth — The Blueprint to Quickly Build Tax-Efficient Wealth to Achieve Financial Freedom in Four Actionable Steps.

In one of the chapters of my book, I share some of the main obstacles to building tax-free or tax-efficient wealth. One of the obstacles I discuss is taxes.

If you ask most Canadians what their biggest expense is, they will most likely say it’s housing costs — mortgage or rent. If you listen to the news media, they are always talking about the top three household expenses:

1. Housing (mortgage or rent)

2. Car payments (loan and interest)

3. Kids education or childcare (student loans or daycare expenses)

Unfortunately, they are all wrong! According to a recent report from the Fraser Institute, the average Canadian family spent 43.6 percent of their income on taxes in 2018, more than they spent on housing and other expenses combined.

Can you imagine that?

This is significant. The average family’s total tax bill at 44 percent is double the amount they’re paying on housing costs each year.

The total tax bill considered in the Fraser report reflects taxes families pay to the federal, provincial and local governments — including income, payroll, sales, property, carbon, health, fuel and alcohol taxes.

Every day, taxes are stealing your money as you can see from these numbers. The worst part is that taxes don’t just steal your money, they also steal your time because time is money.

Consider this. The average person in a developed country (Canada included) spends 20 to 35 percent of their life working to pay taxes, i.e. more than two hours of every workday of the average person are dedicated to feeding the government.

If you do the math, this is equivalent to approximately 13 years in your work life and 20 years in your lifetime.

This is a prison sentence!

And it will get worse. With the increased government spending that just got out of control with the government’s economic response to COVID-19, we expect to pay higher taxes in the future to deal with the rising debt level. In addition, as inflation spikes, the spending power of our currency will be dramatically reduced.

To appreciate the impact of taxes on the qualify of your lifestyle, I challenge you to do this simple exercise. Look at your tax data for the past decade (10 years) or 2 decades and summarize all your income (Line 150 of your tax return), taxable income (Line 260), and taxes paid (Line 435).

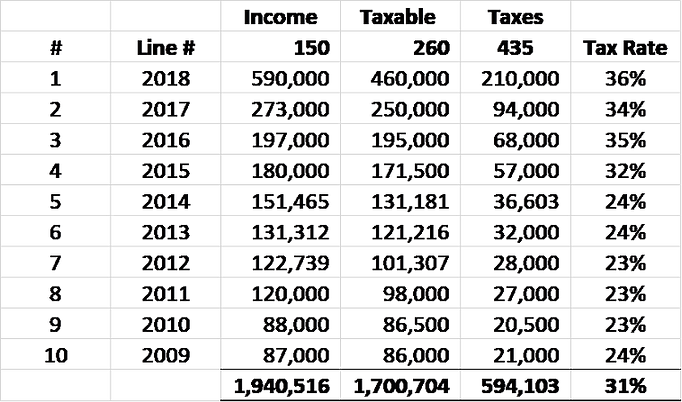

Calculate the tax rate by dividing Line 435 by Line 150. If you’re married, do the same for your wife. You should have a data summary that looks like the sample below:

Note that this is just income taxes. If you add payroll taxes, sales tax, property tax, and all the other taxes you pay, you will be approaching 50% or more in total taxes paid.

Once you have your data, ask yourself these three simple questions:

1. Of the total income I earned in the last decade, how much of it did I keep?

2. How did I manage the income I kept? In other words, how did I invest it and how much has it grown over the last decade?

3. What do I have to show for all the income that poured into my life over the last decade? What impact have I created in my community?

In this example, the taxpayer earned over $1.9 million in the last decade and paid 31% of that in income taxes alone. On top of this, he/she would have paid close to another 20% in other forms of taxes, with less than half of the income left to take care of lifestyle and to invest for the future.

A good yardstick for measuring how well you’ve managed your taxes and finances is to look at your net worth.

Considering this example, if the taxpayer’s net worth today is significantly less than $1.9 million, then she has not paid attention to managing her taxes and finances.

The tax-smart Canadian with $1.9 million in income would arrange her affairs to pay less in taxes and would more than likely have over $1.9 million in net worth today.

In my book, I reveal the blueprint for permanently reducing your taxes and growing your wealth in a tax-efficient manner.

This week, I’m challenging the participants in the training to do a similar exercise. One of the reasons I’m asking the participants to do this exercise is to give them the opportunity to confront their past and current financial position.

When it comes to our finances, we all carry some shame from past financial mistakes. And some blame as well. So, your ability to confront your current financial position is perhaps the only way you can be motivated to make changes that will improve your future financial position.

In her book, Your Money or Your Life, Vicki Robin suggests that you confront the results of your financial behavior in the past, stomach it, and accept it in a “No Shame, No Blame” way. By doing this, you will be motivated to learn from your mistakes and develop new money habits.

You will learn to move past your mistakes, forgive yourself for the bad behavior in the past, and move forward in a “No Shame, No Blame” way to design the life you want to live.

The ability to confront is one of those character dimensions we all must develop to be successful in life. In his book, Integrity, Dr. Henry Cloud quoted one of his favorite sayings…

“Reality is always your friend”

If you don’t embrace the reality of your financial position, you will be living a false life and you will have little or no chance to be successful, financially.

Final Thoughts

So what do you have to show for all the money you’ve made in your life?

Do the exercise by gathering the data for all the money that has poured into your life.

Look at your current financial position to see how much of it you kept.

If your net worth shows you’ve kept all or more of it, you’ve done well.

If your net worth shows you’ve managed your finances poorly, then confront the results of your financial behavior in the past, stomach it, and accept it in a “No Shame, No Blame” way. By doing this, you will be motivated to learn from your mistakes and develop new money habits.

P.S. It’s not late to join the FREE training I’m providing this week. You can watch the replays for sessions you missed. This week, I’m sharing all I’ve learned about personal finance. I will show you how you can move from a place of uncertainty in a time such as this to a place of confidence and certainty with your finances.

This is a different learning experience as you will have the opportunity to ask questions, work on implementing what you learn each day, and actually get some great results at the end of the week.

Also, I will give you my brand new book, TAX-EFFICIENT WEALTH as a thank you for joining.

Join the Challenge here and get a FREE eBook version of my new book!