An American tourist was complimenting a Mexican fisherman for his excellent catch and asked how long it took him to catch them.

“Not very long,” answered the Mexican.

“Why don’t you stay longer and catch more?” asked the American. The Mexican explained that his small catch was sufficient to meet his needs and those of his family.

“But what do you do with the rest of your time?” the American asked.

I sleep late, fish a little, play with my children, and take a siesta with my wife. In the evenings I go into the village to see my friends, have a few drinks, and sing a few songs. I have a full life.”

The American interrupted, “Well, you should start by fishing longer every day then you can sell the extra fish you catch. With the revenue, you can buy a bigger boat, which will bring in more fish and more revenue, until you have a fleet of trawlers. Instead of selling your fish to a middleman, you can negotiate directly with the processing plants. You can move to Los Angeles and direct your huge enterprise from there!”

How long will it take?”

Twenty, twenty-five years maybe?”

“And after that?” asked the fisherman.

“After that, you can retire in a tiny fishing village, sleep late, fish a little, play with your grandchildren, take a siesta with your wife, spend your evenings seeing your friends, have a few drinks, and sing a few songs!”

This story illustrates the devastating effects of endless desires on our lifestyle.

As Vicki Robin noted in her brilliant book, “Your Money or Your Life,” most of us picture financial independence as an unreachable fantasy of inexhaustible riches. This is financial independence at a material level.

She goes on to make the point that if we look at financial independence at the material level, it will only require us to be rich. But what exactly is rich?

Rich exists only in comparison to something or someone else. What this means is that you may never be rich enough.

“Men do not desire to be rich, only to be richer than other men.” John Stuart Mill

According to Vicki, financial independence has nothing to do with rich. It is the experience of having enough — and then some.

Enough is when you get to the peak of your fulfillment curve. In other words, you have enough money to survive and get all the comfort and luxuries you require to experience fulfillment in life.

It is quantifiable. It is achievable. Enough for you may be different from enough for your neighbor as what fulfills you may not necessarily fulfill your neighbor.

This concept of financial independence will allow you to dig deeper to find what fulfills you. It will allow you to plan and design the lifestyle that will fulfill you. More importantly, it will save you from all the hassles of trying to keep up with the Joneses.

So, how do you break free from this constant feeling of lack — the feeling that you don’t have enough?

Here are 9 ways:

1. Develop a better money mindset

“Money is only a tool. It will take you wherever you wish, but it will not replace you as the driver.” — Ayn Rand

A money mindset is your unique and individual set of core beliefs about money and how money works in the world.

It is your overriding attitude about money.

It shapes what you believe you can and cannot do with money, how much money you believe you’re allowed, entitled, and able to earn.

It shapes how much you can and should spend, the way you use debt, how much money you give away, and your ability to invest with confidence and success.

If you don’t know your money mindset, it may be very challenging to make money. So, given the powerful impact your money mindset has on your relationship with money it is important to understand your money mindset.

When it comes to money mindset, there are two extremes — Scarcity/Lack and Wealth/Abundance.

Most of us will fall in between these two extremes.

If you think money is a scarce commodity, you’ll feel stressed and anxious. You won’t be generous.

On the other hand, if you think that there is enough money to go around, you’ll feel calm, positive, and optimistic. You’ll openly share and be more generous.

One suggested approach for uncovering your money mindset is to test yourself by marking True or False to the following statements:

- I’m no good with money

- I always make the wrong money decisions

- I’m financially learning disabled

- I’m no good with numbers

- Money can’t buy you love

- Money makes the world go around

- Rich people are snobby and shallow

- Poor people are hardworking and noble

- There’s a limited supply of money in the world

This exercise along with many other ideas can help increase your awareness of your money mindset.

2. Be intentional about your financial goals

I encourage you to start by considering what you want in life and how you want your life to look like including your finances, emotions, relationships, etc.

Once you know what you want in life, it is easy to plan on how to achieve it. Look at all aspects of your life and determine what your purpose in life is. Your purpose in life gives your life meaning.

Therefore, you must set financial goals. These goals will then inform your plans. By setting your goals, you recognize where you currently stand and where you want to go. Once you know where you are and where you want to go, you can quantify the gap you need to close. You then plan to close the gap by intentionally taking steps each day to accomplish your financial goals.

“If you don’t know where you are going, you’ll end up someplace else.” — Yogi Berra

Setting financial goals will allow you to create realistic plans, track your progress, force you to prioritize, and crate the accountability required to achieve your goals.

3. Know your GAP and live on a budget

I wrote about the GAP in an earlier article. You can read it here.

One of the greatest mistakes I made and one that most people make on the path to financial freedom is the lack of a strong focus on the “GAP.” The math equation below illustrates what the “GAP” is:

To avoid lifestyle inflation, you need to obsess about the “GAP”. If you do this, you will automatically pay attention to all the variables that make up the “GAP” — your income, your expenses, and your taxes.

By doing this, you will live within your means and you will increase your savings rate. Living on a budget will allow you to accomplish this. One of the keys to winning with money is simple: Budget!

With your budget in place, you’ll know exactly how much you can spend and keep lifestyle inflation at bay! A budget does not restrict you, rather it gives you permission to spend money…on those things, you’ve already budgeted for.

4. Join a community of like-minded people

Being a part of a community of like-minded people working together to accomplish shared goals is one way to break free from the feeling of lack in your life.

There is magic in a thriving community of like-minded people.

There is joy in being a part of something bigger than yourself.

There is joy in working towards a common goal.

There is joy in building skills and getting better together,

And there is the safety to be vulnerable and to navigate challenges together.

This is what community is all about. A place where you can share ideas, learn from others that are on the same path as you, and have the fulfillment that together, you’re all accomplishing your financial and life goals. Our Tax-Efficient Wealth Membership is an example of a community like this that you should consider joining.

5. Avoid costly money mistakes

Most of us start our journey in life with little or no preparation on how to manage our money…

We don’t learn it at school.

We don’t learn it from our parents.

We don’t learn it from friends.

So, we start our life journey without this important knowledge, and as a result, we end up making too many mistakes. Some will learn from their mistakes, others will not.

These money mistakes will derail you from your financial goals and will put more pressure on your feeling of lack. In my article, 9 Money Mistakes to Avoid, I share some money mistakes you can avoid to keep you on track with your financial goals.

6. Track and visualize your financial progress

Anything that is not measured is not improved.

By tracking and visualizing your progress each day, you accomplish two objectives:

- You reinforce your habit through self-accountability.

- You boost motivation as you visualize your progress.

So, why is measuring financial progress necessary?

Well, it is important because it is the only thing that will help you keep track of your spending and saving habits and assess where you are headed financially.

In addition, it will help you understand your risk tolerance, investment, and debt management strategies. Statistical research shows that people who track their progress and develop a plan in accordance with it are more likely to reach their goals faster.

7. Get an accountability partner

This is probably the most important step you can take. Establishing a good relationship with an accountability partner will have a significant impact on accomplishing your financial goals. However, care must be taken to ensure you get an accountability partner that is the right fit for the task you’re looking to accomplish.

You want someone that will encourage you, push you beyond your comfort zone, and provide support when needed. Your accountability partner may be a friend or coworker. It could also be a professional advisor or money coach.

8. Resist the pressure to keep up with the Joneses

This one is huge. It is huge because it is more of a money mindset. Because we are social animals, a lot of our money life is also about how we show up in society.

So, there is always enormous pressure to be like the neighbor next door even though we know nothing about this neighbor.

The fact that your friend’s daughter is playing soccer, basketball, and taking music classes doesn’t mean your daughter needs to do it too. You’re still a good parent if your child’s only extracurricular activity is swim lessons at the community pool.

You should not devalue your March break staycation or road trip because you were at a party where friends and other guests shared their experiences on a 14-night European cruise.

In her best-selling book Love Your Life, Not Theirs, Rachel Cruze says…

“Too many people allow cultural expectations and other people to dictate their own values and family priorities.”

This is so true. And it is worse today with the additional pressure from social media. As you scroll through the social media news feed, it’s so easy to take a peek into someone else’s life and compare yourself to their highlight reel.

So, resist falling into the trap of letting the way others spend their money dictate the way you spend yours. The truth is your friends and the Joneses you’re trying to keep up with are probably broke trying to keep up with others.

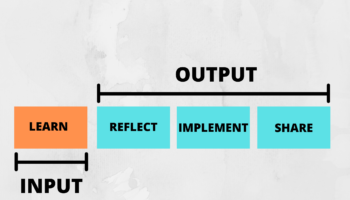

9. Build your knowledge

“Learning is not attained by chance, it must be sought for with ardor and attended to with diligence” — Abigail Adams

I had a chat with a friend a few weeks ago who recently invested $40,000 in a U.S Commercial Real Estate Education and Coaching Program.

When I asked him why he invested that much in a program, he replied “If I don’t invest in my education, who will?”

I watched this friend invest $20,000 in a similar program in Canada not too long ago. In less than two years, he did two commercial real estate transactions and made more than 10X the amount he invested in the program.

Most people stop their education as soon as they graduate with a Bachelor’s degree. They fail to realize that most Bachelor degrees don’t prepare you for financial success.

When you stop investing in continuing education, you don’t build the knowledge that is required for success.

You’re too busy at work and distracted by social media that you have no time to read. The majority of people will only read one book per year, thus missing out on an amazing learning opportunity.

You fail to realize that the more knowledge you have, the more competent and confident you will be. The more knowledge you have, the better your decisions. Decisions that can open opportunities for you.

Reading is part of my daily routine. I read and journal every day. I listen to audiobooks as I work out and as I drive. I’m constantly reading and listening to insightful content on topics that help me get better at my game.

You can do the same too. Make learning a priority. Make building knowledge and learning new skills a priority. If you do this every day, you will be a better version of yourself in a couple of months. And you will automatically earn more.

“Personal confidence comes from making progress toward goals that are far bigger than your present capabilities.” — Dan Sullivan

As you grow in your knowledge, you will start to take meaningful action that drives you closer to your long-term goals. As you take action and make progress, your confidence grows. And the more confident you become, the bigger actions you can take.

Investing in yourself is critical. It is fundamental to making huge leaps in your business or professional career.

Conclusion

You can break free from the feeling of lack in your life if you learn how to master your money from these nine ways I shared in this article.

You will win the money game if you develop the right money mindsets, and plan your journey to align with what matters to you.

Having enough and getting to financial independence requires clarity. It requires purpose. It requires a change in money mindset. It will take careful planning. It requires a certain level of knowledge. And it will require intentional execution using a strategy that makes sense for you.

As you learn to spend less, earn more, and invest wisely, you will naturally possess money.

Once you possess money, you have control. With control comes FREEDOM and the end of a feeling of lack.

P.S. I am on a mission to arm you with financial education. That’s one reason I created the Tax-Efficient Wealth Membership Network and that’s why I wrote Tax-Efficient Wealth. This book will help you accelerate your wealth in a tax-efficient way. Grab a FREE eBook version of my new book, Tax-Efficient Wealth, to learn how you can build wealth quickly using strategies that will save you a ton in taxes.