“Without knowledge action is useless and knowledge without action is futile.” — Abu Bakr

As we come to the end of the 5 Days to Financial Certainty Challenge tomorrow, we will be discussing how you can take all the training this week and make them a reality in your life.

So far this week, we’ve covered the following:

Day 1

- We defined a money mindset. A money mindset is your unique and individual set of core beliefs about money. It is your overriding attitude about money. It shapes what you believe you can and cannot do with money. How much money you believe you’re able to earn. How much you can and should spend, the way you utilize debt, how much money you give away, and your ability to invest with confidence and success. Your money mindset is important because if you don’t have the right mindset, you won’t get it right with your money. The right mindset is required for true financial freedom.

- We discussed the two extremes when it comes to money mindset — Abundance and Scarcity. If you have an abundant mindset, you will be at peace with your money, you will be calm and you will have a positive outlook on life. If you have a scarcity mindset, you will be stressed, anxious and you will not be generous.

- The #1 reason you worry about money is that you don’t know your number. You don’t know how much you need to retire. You don’t know how much your life cost.

- We discussed the concept of “Enough”. Enough is what you need. And it is quantifiable. It is achievable. Enough is when you get to the peak of your fulfillment curve. In other words, you have enough money to survive and get all the comfort and luxuries you need to experience fulfillment in life.

- Financial independence has nothing to do with rich. Rather, it is the experience of having enough. The quote from John Stuart summed it up nicely. “Men do not desire to be rich, only to be richer than other men.”

- If you have a million dollars today, it may not be sufficient to retire comfortably. Grant Cardone said “The Middle Class in America are single-digit millionaires that are worried about money every day”. If you want to build wealth faster, you need to save at least 40% of your gross income. And it can be done with careful planning.

Day 2

- To plan your money journey you start with the end in mind by casting a very clear vision of what you want in life. Casting a clear vision begins with your dreams for the future. Dreams have power and they help increase your imagination by allowing you to see possibility in your life beyond your current circumstances. This quote by Albert Einstein captures the power of imagination: “Imagination is more important than knowledge. For knowledge is limited to all we now know and understand, while imagination embraces the entire world, and all there ever will be to know and understand.” — Albert Einstein

- We established a link between your vision and your goals and suggested that you distill your vision into decade long goals, annual goals, and quarterly goals. I introduced a framework that can be used to break down your quarterly goals into your weekly outcomes and your daily tasks.

- It is important to set goals that stretch you as this is critical for making progress and building confidence. Dan Sullivan’s quote captures this succinctly: “personal confidence comes from making progress toward goals that are far bigger than your present capabilities.”

- It is important to review your past money mistakes so you can learn, deal with it and move forward in a No Shame, No Blame way.

- You must assess your current financial situation to determine how far you are from your future goals. This will give you clarity and this will form the basis for your unique plan to achieve financial independence.

- It is critically important to think BIG! When it comes to planning your money journey, you must resist thinking day to day, week to week, or even month to month. You must think long-term — 5 years, 10 years, 20 years or more.

Day 3

- We discussed the major obstacles you will have to deal with as you plan your money journey.

- Taxes is your biggest expense as total household tax bill in Canada is approximately 44%. You pay taxes on everything — income taxes, payroll tax, sales tax, property tax, carbon tax, health tax, fuel, and alcohol taxes. So, it is a major obstacle to building wealth.

- The interest cost you pay on the mortgage on our primary residence is not deductible for tax purposes. As such it puts additional pressure on your ability to build wealth quickly. This is another major obstacle to achieving financial freedom.

- We discussed the dangers of endless desires and why it will keep you spending all the extra income you make. Endless desire thrives on the myth that “more is better”. It is the insatiable desires that drive most Canadians to buy and buy and buy. It is a consumer mentality.

- Lifestyle inflation is also an obstacle to building wealth. This happens when your household spending rises to match your rising income. In other words, your lifestyle expands to match the extra income from your paycheck. As a result, you have no money left at the end of each month.

- Living in denial is dangerous for your financial wellbeing. If you continue to live in denial of your financial mistakes, you cannot make progress financially. 90% of solving a problem is realizing there is one.

- It is important to get out of the employee mentality as this leaves you with little or no cash flow at the end of each month. With the employee mentality, you earn, pay taxes, and use whatever is left to cover your regular expenses.

- And lastly, we considered the significant impact of inflation and concluded that if left unchecked, inflation will rob you. It will reduce your purchasing power and it will slowly kill you financially. “Inflation is taxation without legislation.” — Milton Friedman

Day 4

- I presented the blueprint for building tax-efficient wealth. The blueprint is based on the three key goals you want to achieve when it comes to managing our finances tax-efficiently. First, you want to save and accumulate capital tax-free or tax-efficiently. Second, you want to invest the capital and grow the capital tax-free or tax-efficiently. And finally, you want to withdraw the money to fund our lifestyle and other causes important to you on a tax-free or tax-efficient manner. This can be done. But it requires careful planning. And that planning will be the backbone of your strategy.

- When it comes to building wealth and achieving financial freedom, you need tools. Simple tools like Tax-Free Savings Account, Registered Retirement Savings Account, Businesses, Real Estate, and Tax-Exempt Life Insurance can be used with careful planning to save on taxes.

- Your desired goal at the end of the day is to find ways to save and store more cash. Find investment vehicles to grow the money you’ve saved tax-free or tax-efficiently. And you want those investments to generate sufficient monthly cash to fund your cost of living. This is how you achieve financial freedom. Freedom from money worries. Freedom from working at a job you hate. Freedom from dealing with employers that disrespect and undervalue you. Freedom to do the work that fulfills you, with the people you want to work with and at the time that you choose.

Tomorrow, we will discuss how you can take all of these and apply them to your life. And you do that by execution.

“To me, ideas are worth nothing unless executed. They are just a multiplier. Execution is worth millions.” — Steve Jobs

If you want transformation in your life, you have to execute.

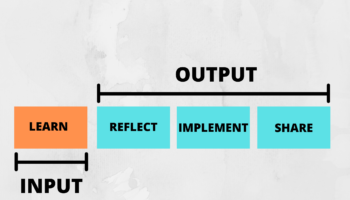

You have to move from head knowledge to actually implement the ideas you’ve learned. If you don’t execute, nothing happens. Your life will not change. You will not be better than you were yesterday.

To execute, you must develop systems that will make execution effortless.

You need a system to execute your priorities every day.

A system that will allow you to breakdown your decade long goals into annual goals, and eventually to your daily tasks.

You are three times more likely to achieve your goals by stating your implementation intentions. You can use the 3×3 Achievement System to reach your life goals by breaking down your:

- Quarterly Big 3 Goals

- Weekly Big 3 Outcomes

- Daily Big 3 Tasks

By doing this, you ensure that you are doing at least one thing each day towards your long-term goals. And by taking one step towards your big goals every day, you’ll soon achieve your life goals.

Distraction is the main reason most people don’t execute well.

Distractions steal your time and clutter your focus. As such, to be successful in reaching your life goals, you must be brutally focused. You must minimize everything that does not advance your long-term vision daily.

Staying focused can be challenging, particularly given that we often have more things to do than time to do them.

So, instead of figuring out how to get more done, you should be asking, “What work is the best possible use of my time?”

“You can do anything you want, but not everything you want.” — David Allen

So how can you make execution effortless?

Here are 5 ways you can do this:

1. Find a System that works for you

You must start by developing a system that works for you. This must include writing down your goals and clearly documenting what you want to accomplish.

I use the 3×3 Achievement System discussed above and have found that it has dramatically improved my results of completing the things that matter most to me.

2. Regularly assess how you spend your time and energy

Do this by reviewing your calendars, writing things down, and keeping a journal.

I use a one-page calendar schedule where I write on a daily basis my top 3 90-day goals, my top 3 30-day goals, my top 3 weekly goals, and my top 3 daily tasks.

I find that by writing my goals down daily, it keeps it front and center on my mind. It keeps me motivated.

At the end of each day, I assess how I spent my time and make important notes on what went well and what I can improve.

3. Align your daily tasks to your goals

Always ask yourself, “Is there a way that this contributes to my long-term goals?” If the answer is “yes,” then all good. If the answer is anything other than “yes,” then delegate, defer or delete.

The use of the one-page calendar schedule helps me. As I write my goals down daily, it keeps it in focus, and it helps me align my daily tasks to my 30-day and 90-day goals.

4. Be ruthless with accomplishing your daily big three tasks

Doing this will give you massive momentum towards your long-term goals. If you get your big three daily tasks figured out, start with the hardest task, and do nothing else until you complete it. Then move on to the next task.

I have found this very helpful. It gives me great momentum towards getting important things completed. Even on days when I get off track and lose focus on my top 3 tasks, I still manage to get at least 1 or 2 of my top 3 tasks completed.

Here, it helps to be very specific on the tasks to be completed. For example, “Complete the first draft of chapter one of my eBook”.

5. Invest in self-awareness

Whatever that is for you. Spiritual, meditation, books — these things will help you figure out who you are, where you’re going, why it matters, what matters, and what doesn’t.

Do this every day and you will magically find the motivation to drive you towards your goals faster.

“One can steal ideas, but no one can steal execution or passion.” — Tim Ferriss

By regularly assessing how you spend your time, you may find the following as examples of things you can cut out of your life:

- People that distract you from your long-term vision

- Events/conferences and social gatherings that don’t inspire and add value to your long-term vision

- Social media is an addictive waste of time and energy

- Checking your messages and emails every time your phone beeps

- Picking your phone every time it rings

- Excessive addiction to news media

- Doing chores you don’t enjoy when you can pay others to do them

- Watching excessive TV

- Wasting too much time learning and doing tasks that someone else can do, particularly tasks you don’t enjoy doing

- And many more that I can’t list here…

“Never do anything that someone else can or will do, when there is so much to be done that others cannot or will not do.” — Dawson Trotman

In Conclusion

Mastering how to execute will make a significant difference in your life.

If you want to accomplish your financial goals in life, you must execute the plans you’ve put together.

Without execution, nothing changes.

“Strategy equals execution. All the great ideas and visions in the world are worthless if they can’t be implemented rapidly and efficiently. Good leaders delegate and empower others liberally, but they pay attention to details, every day.” — Colin Powell

P.S. It’s not late to join the FREE training I’m providing this week. You can watch the replays for the sessions you missed. This week, I’m sharing all I’ve learned about personal finance. I will show you how you can move from a place of uncertainty in a time such as this to a place of confidence and certainty with your finances.

This is a different learning experience as you will have the opportunity to ask questions, work on implementing what you learn each day, and actually get some great results at the end of the week.

Also, I will give you my brand new book, TAX-EFFICIENT WEALTH as a thank you for joining.

Join the Challenge here and get a FREE eBook version of my new book!