Don’t settle for a life of financial struggle

If you listen to the news media, you’re already aware that growing household debt is a major reason most people struggle financially.

This debt is mostly consumer debt incurred as you live beyond your means. You develop poor money habits that keep you in this cycle of financial lack from month to month and from year to year.

And before you know it, you’re 65 and broke!

One reason you don’t make financial progress is that you don’t track key elements of your finances as often as you should. What is not tracked is not measured and what is not measured is not improved.

In a previous article, I challenged you to an exercise to review the total income you’ve earned and the total taxes you’ve paid in the last decade.

If you did the exercise, you may have learned something about your past financial habits. If you have not done it, you can read the article here and consider doing it. This exercise may reveal something shocking about the way you’ve managed your finances over the last decade.

I did the exercise by looking back to several years of my tax data. Although what I discovered was not a complete disaster, it revealed that I’ve done a mediocre job managing my finances over the years.

For many years I lacked financial awareness and made so many costly mistakes along the way. Today, I am more aware. I can avoid costly mistakes and I can adjust quickly when I make minor mistakes along my journey to financial freedom.

One of the greatest mistakes I made was thinking that generating more and more income will solve all my money problems. This is a common mistake most entrepreneurs make. As a result, we lose focus on the “GAP”. The math equation below illustrates what the “GAP” is:

For many years, I obsessed with growing my earned income and paid little attention to the “GAP” or anything else for that matter in the equation above.

By not paying attention to the “GAP” and by not tracking the various elements that make up the equation, we lose our financial focus. It is one of the leading causes of high-profile bankruptcies — both in our personal lives and in our businesses.

While there are so many reasons why people struggle with finances, here are 4 common reasons:

You think that earned income is king

I know a lot of people that earn $100,000 per year and live a $100,000 per year lifestyle. I’m sure you know a few people like this as well.

By living a $100,000 lifestyle on a $100,000 earned income, you end up broke. Quite often, you live a $150,000 lifestyle on a $100,000 income. This is one reason why high-profile celebrities declare bankruptcies. They make a million dollars, refuse to pay taxes, and spend the entire million dollars.

Consumption pressure

If you live in a Western economy like Canada, you are bombarded each day with the lure of consumption. It is in everything we see, hear, touch, and smell.

We’re constantly bombarded by advertisements to buy and buy and buy…it is unstoppable.

This pressure to consume drives up our expenses as we end up acquiring things we don’t need. We end up buying new rather than used.

We want to keep up with the new trend in fashion and electronic gadgets. It is a crazy world of consumption and it is certainly the reason why consumer debt is going through the roof.

You ignore taxes

This is another big one that most people are likely unaware of. There are two main reasons for this.

First, they don’t even know it is their biggest expense, particularly for those that make a decent income.

Second, most people resign to the false belief that they can do nothing about their taxes. You can reduce your taxes. You just need to increase your knowledge and plan accordingly.

Keeping up with the Joneses

This one is huge. It is huge because it is more of a money mindset and it drives our behavior as it relates to the income and expense variables in the equation above.

Because we are social animals, a lot of our money life is also about how we show up in society.

So, there is always enormous pressure to be like the neighbor next door even though we know nothing about this neighbor. In fact, we may even hate this neighbor. Yet, there is a pull in our nature to want to keep up. Often, this often leads to a negative “GAP”.

A better approach to financial well-being is to obsess about the “GAP”. If you do this, you will automatically pay attention to all the variables that make up the “GAP” — your income, your expenses, and your taxes.

From my own personal experience and from what I have seen over the years working with many clients, you will struggle financially if you don’t focus on maintaining a positive “GAP”.

And to accelerate your wealth in a tax-efficient manner, you will have to focus on aggressively growing your “GAP”. There are so many ways to accomplish this and here are 5 practical ideas to consider:

1. Be intentional about what you want in life

I encourage you to start by considering what you want in life and how you want your life to look like including your finances, emotions, relationships, etc.

Once you know what you want in life, it is easy to plan on how to achieve it. Look at all aspects of your life and determine what your purpose in life is. Your purpose in life gives your life meaning.

William Damon at Stanford says that purpose is

“A stable and generalized intention to accomplish something that is at the same time meaningful to the self and consequential for the world beyond the self.”

This is key because, without purpose and meaning in life, we often end up being controlled by money. So, you want a bigger purpose in life that allows you to see money as a tool to achieving the life you want.

2. Start with the easy wins

While all the variables in the equation are important, the easiest place to start is with your expenses as this can give you immediate results and momentum.

I recognize it can be challenging to make changes to our everyday life and cut out certain expenses as we’re often reluctant to do this.

One thing that works well is to surround yourself with others that can hold you accountable. Also, you can consider taking an extreme approach and cut out everything.

By doing this, you will often discover things you don’t miss. For the things you really miss, you can bring them back in and figure out ways to pay less for them.

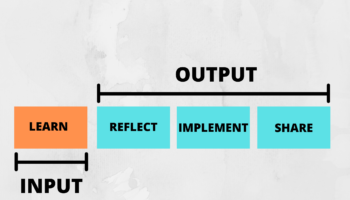

3. Invest in yourself

You will certainly live a mediocre life if you don’t constantly invest in yourself.

If you want to live a fruitful life, read and learn from those that are living a fruitful life and model what they do. If you want to be promoted to earn more income, hang out with those that have been promoted and learn from them. If you want to achieve financial success, model those that have already achieved financial success.

The average person reads about 4 books a year and spends most of his/her time mindlessly listening to news and watching TV. You must be intentional to grow into the life you want by constantly reading, listening to podcasts, and actively implementing the things you learn to grow and get the results you want in life.

I know people that have not changed in 10 years — they still think the same way they did 10 years ago; they still have the same income they had 10 years ago; they still talk the same way they did 10 years ago; and today, they are still broke and continue to hang out with the same set of people. I am sure you know people like this as well.

4. Use your assets

Often, we complain that we have no money or no income, but we’re surrounded by assets that are lying idle.

Assets ranging from our knowledge and experiences to the things we own lying around our homes and the equity sitting idle in our big homes.

You need to be creative in ways you can use the assets you have to generate more income that will help you increase your “GAP”.

5. Invest in real things

One reason many people struggle financially and end up losing money is that they fall into these get-rich-quick schemes. They are always looking to invest in shinny objects — bitcoin today, currency trading tomorrow, and a fancy IPO the next day.

They are always looking for the next big investment for quick money. They invest without a strong understanding of what they are investing in.

Once you grow and build your “GAP”, you need to invest it wisely to grow and accelerate your wealth.

In my opinion, the best way to invest and sleep well at night is to invest in real things such as real estate, viable businesses, and precious metals like gold and silver.

If you must invest in anything, at the minimum, make sure you understand it. If you’re investing in stocks, take the same approach Warren Buffet takes. I love this quote from Jim Paul and Brendan Moynihan, authors of the book, What I Learned Losing A Million Dollars…

“Most people don’t know whether they are investing, speculating, or gambling, and to the untrained eye the activities are very similar”.

Final Thoughts

At the end of the day, the path to strong financial well-being is simply solving this math equation.

Solving the math equation will require you to know all the variables that go into this equation. If you can manage the variables, you can certainly manage your “GAP”.

P.S. Join my mailing list here to be notified of how you can join my 5-Day 1-hour-a-day challenge starting on July 6. This challenge will put you on the path to financial freedom and help eliminate all your money worries forever!